“You can’t tell the players without a scorecard,” yelled the hawkers of olden days at major league baseball stadiums. In the modern days of law practice management, that may still be true.

As I wrote yesterday in part one of this four-part series, the law practice management market has undergone dramatic consolidation, from what was once a robust marketplace of independent competitors to one where now virtually all the companies are owned by just six ownership groups.

So in this post, I present to you a scorecard, describing the major ownership groups and the products that fall under their umbrellas.

As I say later in this post, I do recognize that there are still independently owned law practice management platforms that are not under the umbrellas of any of these ownership groups. I list some below and you can find others in the LawNext Legal Technology Directory. However, virtually all the major players in the market are owned by one of these six groups.

AffiniPay

After Clio launched practice management into the cloud in 2008 and Rocket Matter followed in 2009, the next major cloud-based practice management platform to come along was MyCase, which was founded in 2010 by lawyer Matthew Spiegel (who has since gone on to found the legal CRM company Lawmatics.)

In October 2012, Spiegel sold MyCase to AppFolio, a company that was primarily focused on software for residential property management. In June 2015, AppFolio went public, and then, five years later, in September 2020, it sold MyCase to private equity group Apax partners for $193 million in cash.

In the following years, MyCase went on to make several notable practice-related acquisitions:

- In March 2021, MyCase acquired CasePeer for personal injury firms.

- In March 2021 (approximately), it acquired Woodpecker for document automation.

- In November 2021, it acquired Soluno for billing and accounting.

- In May 2022, it acquired Docketwise for immigration practices.

All of that set the stage for one of the most stunning deals ever in the law practice management space: the June 2022 acquisition of MyCase and its related brands by AffiniPay, the parent company of the electronic payments platform LawPay.

One reason this deal was so stunning, as I wrote at the time, was that LawPay had been the legal tech equivalent of Switzerland, partnering with virtually every practice management platform, but always neutral as to which should win the competition for the market. But in acquiring one of the major competitors, Switzerland suddenly lost its neutrality.

But that was not the end of the story. Last year, in September 2023, AffiniPay sold off Soluno, the accounting software it had acquired, to Actionstep, a practice management platform for midsized law firms, which earlier this month debuted its legal accounting feature built from Soluno’s technology.

Then, in July, the whole AffiniPay group got a new owner, when, on July 17, it was announced that Genstar Capital had become the majority owner of AffiniPay.

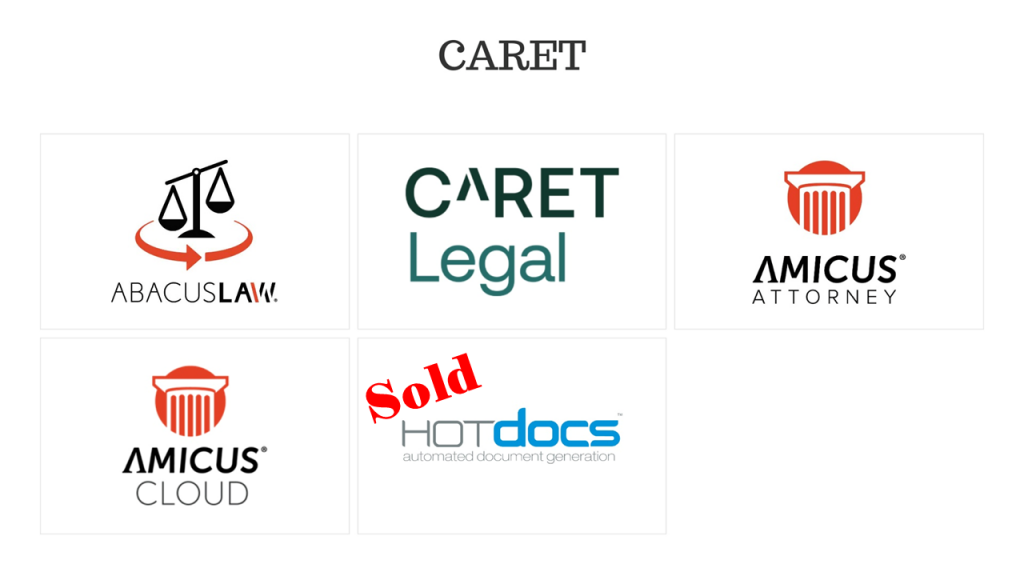

CARET

You might say that CARET represents one of the newest and one of the oldest brands in law practice management software. The CARET brand was introduced just last year, in February 2023, but it was a rebranding of the company formerly known as AbacusNext, a legal tech company that dates back to 1983.

In March 2021, AbacusNext was acquired by Thomas H. Lee Partners, a private equity firm that invests in growth companies. A few months later, in July 2021, AbacusNext acquired the practice management platform Zola Suite, which had been founded in 2015, saying at the time that the goal was to create “the strongest portfolio of legal software solutions on the market.”

With the CARET rebrand last year, Zola Suite was also rebranded as CARET Legal. Just recently, a CARET spokesperson told me that the company’s primary focus going forward will be on CARET Legal, which is its cloud product, while it will also continued to support its legacy, on-premises products AbacusLaw and Amicus Attorney.

Meanwhile, in June, CARET sold off HotDocs, the document automation software first released to the legal market in 1993, to Mitratech. CARET retains exclusive licensing rights to HotDocs within the legal tech market. Just after the HotDocs sale, CARET’s CEO left the company and a search is underway for her replacement.

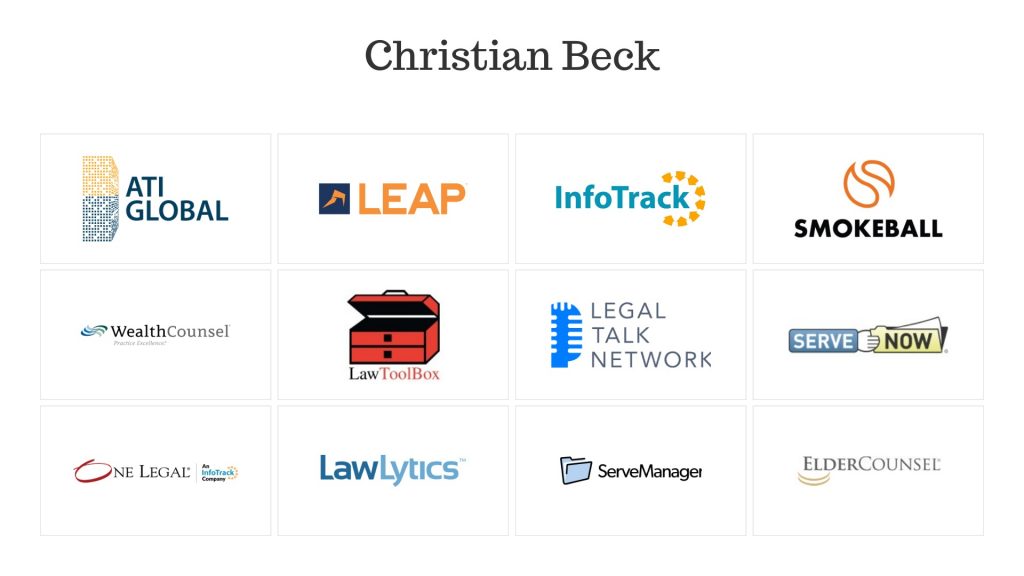

Christian Beck/Australian Technology Innovators

I am sure I will hear from people at LEAP and Smokeball about this grouping, because technically the two practice management companies are separate corporations with separate ownership structures.

However, with regard to all the companies displayed above, all roads lead back to one man, Australian entrepreneur Christian Beck. His company, Australian Technology Innovators, directly owns all the companies shown above except Smokeball, and he is the majority owner of Smokeball, which he cofounded in 2010 with former LEAP employee and now Smokeball CEO Hunter S. Steele.

In fact, a 2021 press release regarding the acquisition of LawLytics described the acquirer as “the Smokeball-LEAP-InfoTrack Group.” The press release described the group this way:

“[A] strong international portfolio of companies with the common mission of making legal practices more efficient and profitable through best-in-class technologies. Christian Beck maintains significant investment in all the Group’s entities and is involved in the Group’s global strategy.”

Note also that the grouping shown above is of products offered in the U.S. ATI owns additional legal tech products that serve lawyers in Australia, Ireland, New Zealand and the U.K.

LEAP’s founding in Australia dates back to 1992 and it claims to be the world’s largest provider of practice management software for law firms. Virtually all of the other products in the group evolved out of LEAP or were acquired. In recent years, this group has made a number of significant acquisitions:

- On March 3, 2020, InfoTrack acquired One Legal, a California provider of online litigation support services such as court filing, service of process, and document retrieval.

- On Aug. 3, 2020, InfoTrack acquired a majority stake in the court calendaring company LawToolBox, also based in Denver.

- On Jan. 13, 2021, InfoTrack acquired Lawgical, the parent company of several legal industry brands, including the Legal Talk Network, which produces some 30 law-related podcasts, ServeNow, which says it is the nation’s largest independent network of process service professionals, and ServeManager, a technology platform for process servers to manage service of process.

- On Nov. 16, 2021, the Smokeball-LEAP-InfoTrack Group (as noted above) acquired LawLytics, a company that provides website management software for small law firms and solo practitioners.

- On Dec. 31, 2021 (but not announced until April 6, 2022), LEAP acquired WealthCounsel, a leading provider of software, training and support for estate planning lawyers, and its related company ElderCounsel.

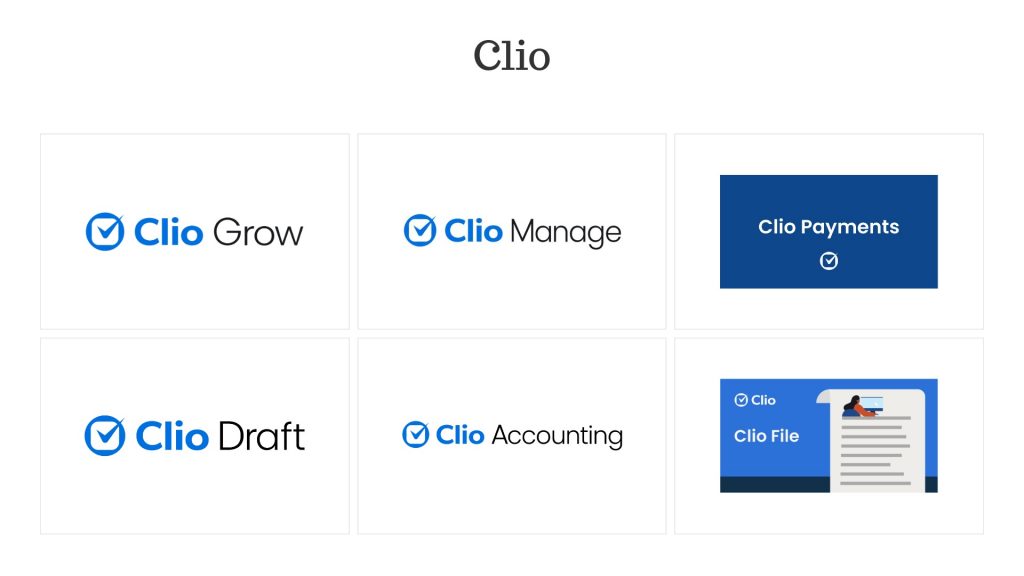

Clio

These days, the 800-pound gorilla of law practice management companies is Clio, which just last month announced a record raise for a legal tech company of $900 million at a $3 billion valuation. The first cloud-based law practice management platform when it launched in 2008, it now claims to have north of 150,000 customers across 130 countries throughout the world.

For all its growth, Clio has made only three acquisitions:

- In 2018, it acquired Lexicata, the CRM platform that became the foundation of its Clio Grow product.

- In July 2021, it acquired CalendarRules, a provider of automated court calendaring. Court calendaring is now built into Clio Manage.

- In September 2021, Clio acquired Lawyaw, a document automation platform that it rebranded earlier this year as Clio Draft.

Rather than acquire, Clio has taken a dual approach of partnering and building. A hallmark of Clio is its integrations with hundreds of third-party applications than enable customers to add to and extend the functionality of the core Clio Manage platform.

Clio’s primary product, its practice management platform, is now called Clio Manage. After it acquired Lexicata, it launched a second product, Clio Grow, In addition, over the past three years, Clio has launched several significant new product types, including:

- In 2021, the launch of Clio Payments, a native e-payments technology built into the Clio Manage law practice management platform.

- The launch last year of practice-specific add-ons to its Clio Manage product for personal injury lawyers and legal aid lawyers.

- The launch in July of Clio File, an e-filing service integrated within Clio Manage and currently available in Texas with other states to be added.

- The launch in July of integrated accounting and bookkeeping software as an add-on to Clio Manage.

- The forthcoming launch of Clio Duo, a generative AI legal assistant integrated throughout its products.

I will talk more about all this in the third part of this series.

Paradigm

The Paradigm story starts in 2017, when the private equity firm Alpine SG (ASG) acquired the time-and-billing software Bill4Time. A year later, ASG acquired the law practice management platform PracticePanther and brought the two companies together under a unified legal technology business, ASG LegalTech.

After making two more significant acquisitions in 2019 and 2021 — of MerusCase and payments platform Headnote — ASG LegalTech rebranded in January 2021 as Paradigm. In October 2021, the Paradigm group was acquired by Francisco Partners, a major investment firm that specializes in investments in technology businesses.

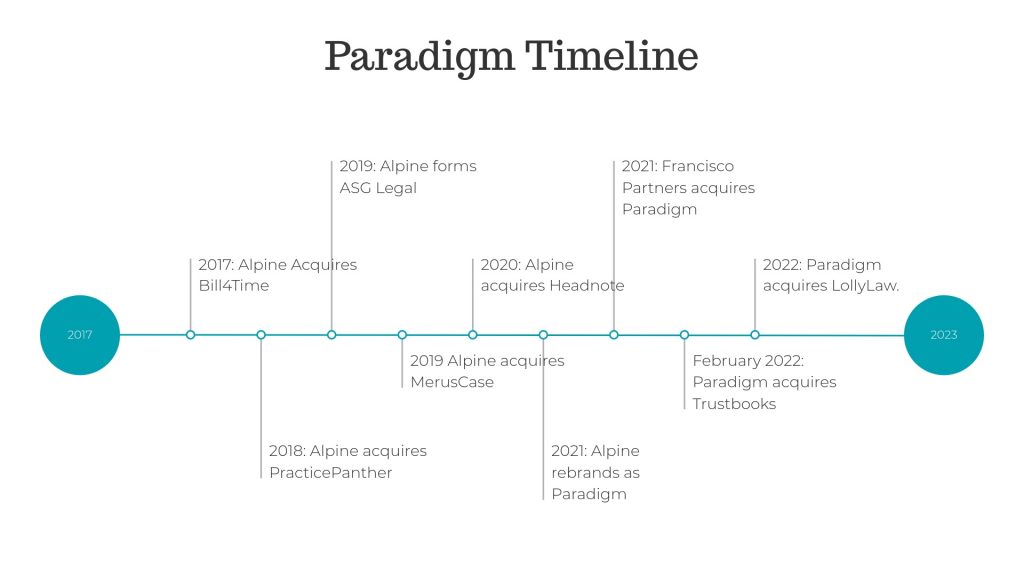

Here is the timeline of Paradigm acquisitions:

- 2017: Alpine Investors acquires Bill4Time.

- 2018: Alpine acquires PracticePanther.

- 2019: Alpine creates ASG LegalTech group, names Soumya Nettimi as CEO.

- 2019: ASG LegalTech acquires MerusCase.

- 2020: ASG LegalTech acquires Headnote, an electronic payments platform for legal.

- 2021: ASG LegalTech rebrands as Paradigm.

- 2021: Francisco Partners acquires Paradigm.

- February 2022: Paradigm acquires TrustBooks, legal accounting software

- April 2022: Paradigm acquires LollyLaw, all-in-one practice management for immigration law firms.

ProfitSolv

As it exists today, ProfitSolv is the end result of the coming together of two groups of law practice management companies that had each already made notable acquisitions.

It all started in September 2020, when the private equity firm Lightyear Capital LLC established the company ProfitSolv to acquire professional services software.

As it announced that new company, it also announced that it had already acquired TimeSolv, cloud-based legal billing and timekeeping software, and Rocket Matter, one of the first cloud practice management platforms, together with LexCharge, the payment processing company that RM had acquired in February 2020.

Meanwhile, back in 2018, Software Technology LLC, developer of Tabs3 Software, a desktop law practice management program founded in 1979, acquired CosmoLex, the cloud-based practice management platform first launched in 2013.

Then, in March 2021, Thompson Street Capital Partners, the private equity firm that owned Tabs3, announced that it had sold the Lincoln, Neb., company “to a new capital partner.” Although it did not reveal the purchaser’s identity, this blog broke the story in July 2021 that it was ProfitSolv.

Also that year, ProfitSolv acquired Clearview Social, an application for law firms to help their lawyers share content on social media.

Other Practice Management Software

I do not mean to suggest that the products listed above represent the entire universe of law practice management products. The image below shows some of the other brands in the market, none of which are owned by the major groups described above.

It also worth noting the products that have come and gone. These include LexisNexis Firm Manager, which LexisNexis introduced in 2011 and closed down in 2017. and Thomson Reuters Firm Central, which TR launched in 2013 and announced earlier this year it was shutting it down.

Watch for Part 3 of this series tomorrow, in which I’ll examine how these companies are likely to develop as they seek to expand their customers and grow their revenue.

Here is the full series:

- The shrinking ownership of law practice management technology (Part 1 of 4): A Market Dominated by Just Six Ownership Groups.

- The shrinking ownership of law practice management technology (Part 2 of 4): A Scorecard of Who Owns What.

- The shrinking ownership of law practice management technology (Part 3 of 4): Future Development and Market Opportunities.

- The shrinking ownership of law practice management technology (Part 4 of 4): Wrapping It All Up.

Robert Ambrogi Blog

Robert Ambrogi Blog