The Clio Cloud Conference is always the occasion for the law practice management company to announce new and enhanced products, and today’s kick-off of this year’s event was no different, with CEO Jack Newton unveiling what he described to me as the most important product release since Clio’s debut 13 years ago.

That product is Clio Payments, a native e-payments technology built into the Clio Manage law practice management platform, allowing lawyers to offer clients secure and compliant credit card, debit card and e-check payments.

More on Clio Payments below, but, in addition, Clio today also announced:

Clio for Clients. This client portal facilitates secure communications and notifications to clients, and now works both on mobile devices through the Clio app and on computers through a web-based portal. Lawyers can use it to provide case updates, notify clients when documents are ready for review, and send and receive messages privately. In addition, the mobile version has a built-in scanner so that clients can scan and upload documents.

Text notifications. Clio said that its new text notifications feature enables firms to send an SMS confirmation to participants when they schedule a meeting in Clio. Recipients receive the meeting details and can confirm attendance directly via text.

Automated court forms. Last month, Clio acquired Lawyaw, a document automation and assembly platform. That followed Clio’s acquisition in July of CalendarRules, an automated court calendaring product. Building on the two acquisitions, Clio said that Lawyaw, which already offered automated court forms for California federal and state courts, has added forms for another five states: Florida, Georgia, Illinois, New York and Texas.

Clio Drive. Clio Drive is a desktop application that allows a user to synchronize documents between the Clio cloud and the desktop. That means a user can create, edit and store documents on a computer while keeping them fully synchronized with the Clio Manage platform.

Clio Ventures. Not a new product, but Clio today also announced the launch of Clio Ventures, an equity investment portfolio for early state companies that are creating innovative solutions aimed at helping transform the legal experience for all. The fund will initially focus on companies building products on the Clio platform, but Newton said it will eventually extend to “companies that align to our vision of creating the connective tissue the industry needs in a legal operating system.”

Integrated Payments

While Clio users already could accept electronic payments through third-party companies such as LawPay, the new Clio Payments is a native solution fully integrated into the Clio platform, which makes the process of accepting and tracking payments far more seamless.

During a preview last week, I asked Newton why he considered this to be Clio’s most important product release since the platform’s launch.

“First and foremost, it is the lifeblood of a law firm,” he said. “If you talk about what makes a law firm survive, it is around an effortless payment experience for clients.”

In a separate statement, Newton elaborated: “Streamlining this single touchpoint has the potential to fundamentally change where legal professionals spend their time — and who can access legal services. We see this as a critical juncture in realizing our mission to transform the legal experience for all.”

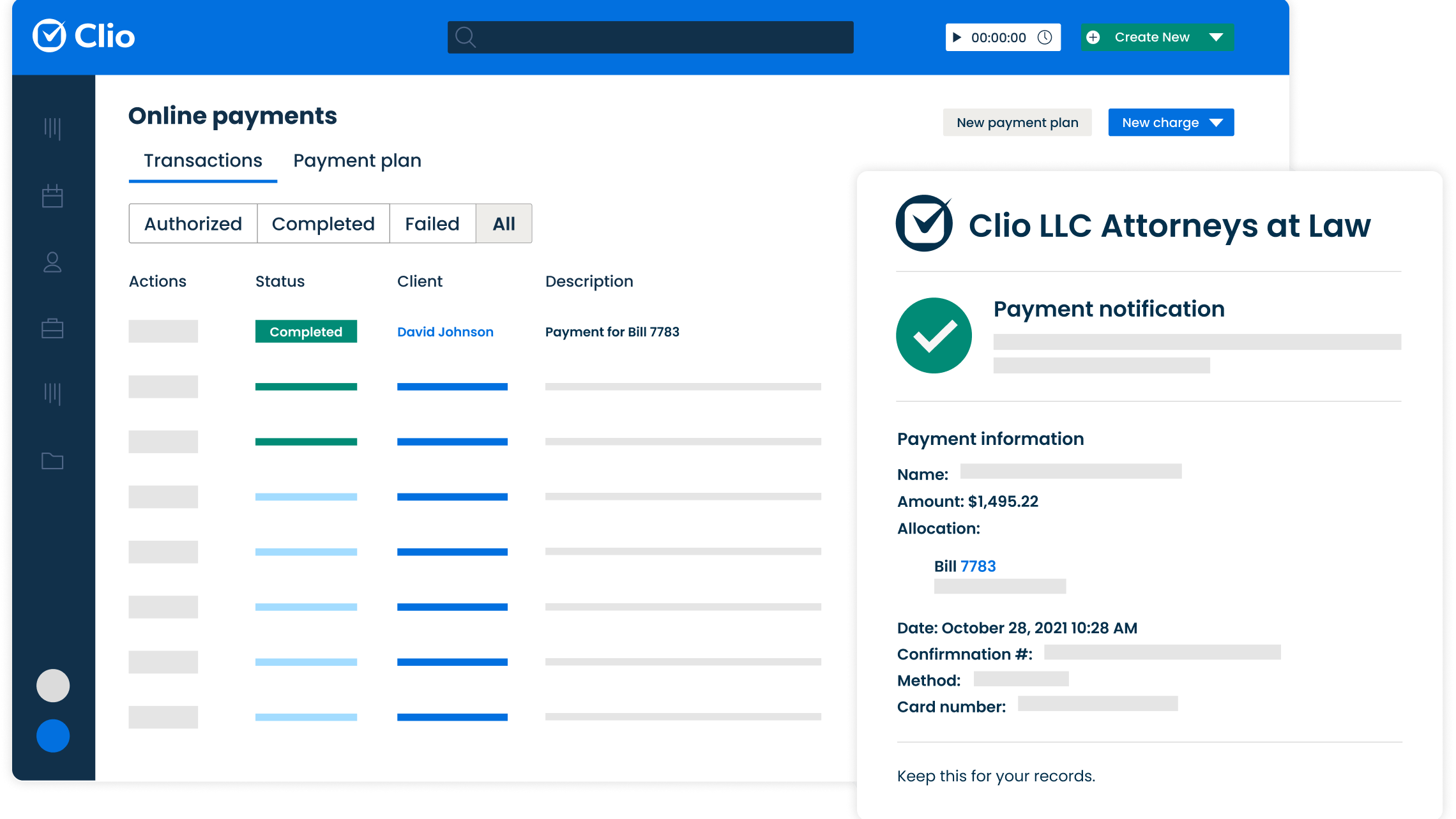

Clio Payments is available as of today within the Clio Manage platform. Payments made through Clio Payments are recorded automatically in Clio and synchronized into the user’s accounting platform (such as QuickBooks or Xero).

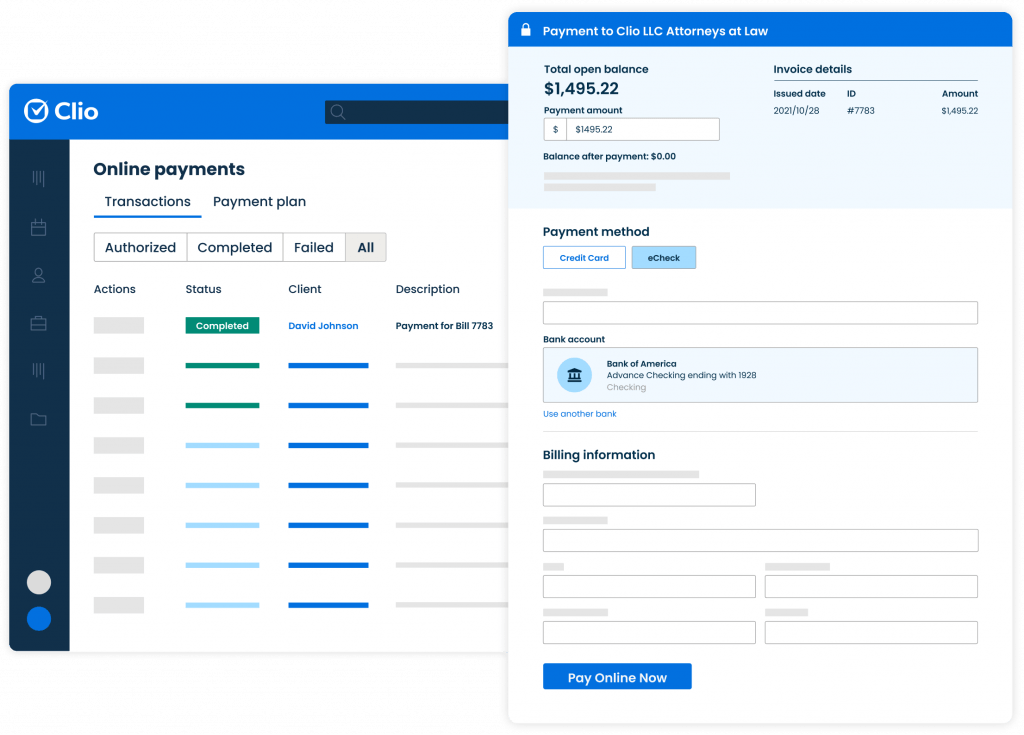

As with any payment processor, users pay transaction fees. However, unlike some processors, whose fees can be confusing, Clio is charging a single flat fee of 2.8 % for all credit card types and a flat rate of $2 for check transactions.

With Clio Payments, when a lawyer sends an invoice, it will include a payment link. The link will take the client to a payment page, where the client can apply a payment of any amount. The client can store credit card information to simplify future payments.

Firms can also use Clio Payments to set up payment plans for clients, scheduling payments to occur in installments over a period of time.

When clients make a payment, the payment shows up within seconds in Clio and is also synchronized to the user’s accounting platform.

In announcing these products, Newton reiterated a theme he has talked often about in recent years, that of Clio’s commitment to building the first comprehensive operating system for law.

“As we define Clio’s next chapter, we see an opportunity to design the first legal operating system, something that is much larger than one software or integration alone,” he said. “We are designing a system that will see the foundational cloud-based and client-centered technologies come together to create the fabric that serves the entire industry.”

Robert Ambrogi Blog

Robert Ambrogi Blog