Joshua Schwadron is fed up with personal injury lawyers’ failure to pass on to their clients the savings they realize from technology.

He is so fed up, in fact, that he is pivoting his legal technology company Mighty – which he originally launched to serve PI lawyers – to bypass those lawyers and go direct to consumers with the promise of free AI-powered settlement negotiations.

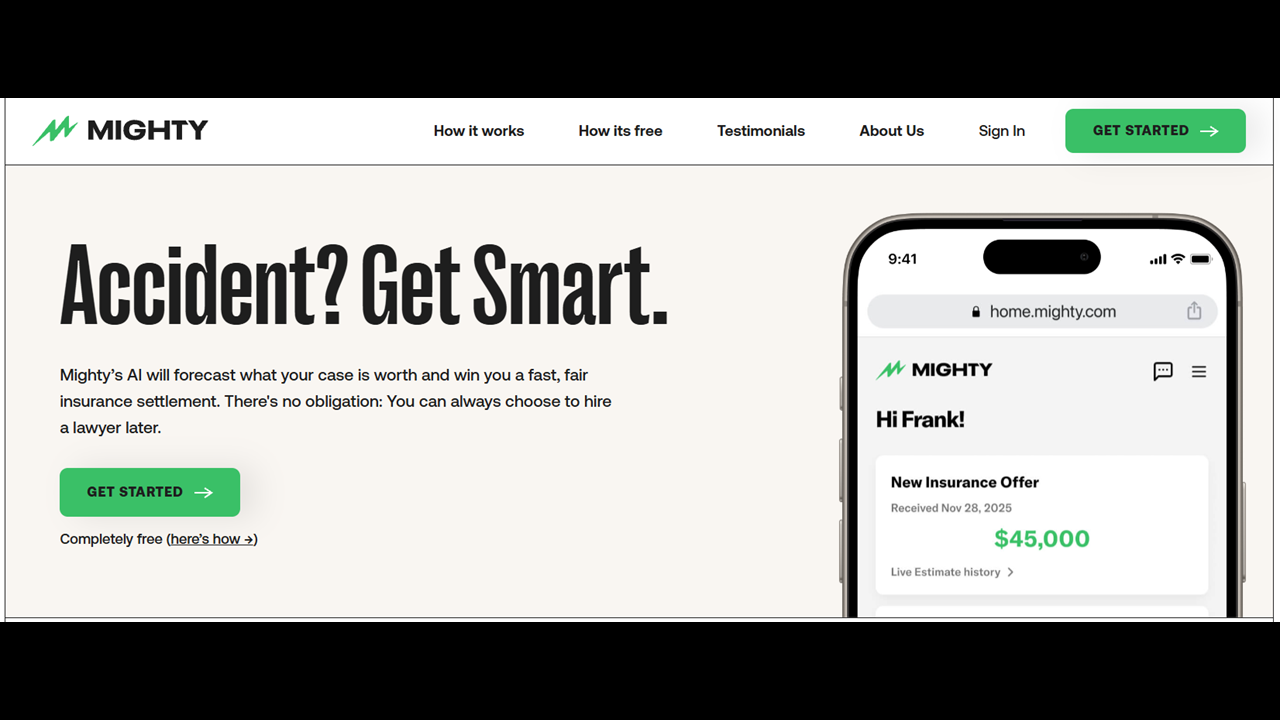

The company has launched a direct-to-consumer AI platform that handles motor vehicle accident claims from valuation through settlement negotiation – all for free – positioning itself as the “first stop” for accident victims before they ever consider hiring a lawyer.

Mighty says it has already settled multiple cases through the platform, all completely handled by AI, without human involvement.

A Pivot After A Pivot

This is not Mighty’s first major pivot. The company started out as a portal that helped PI firms interface more seamlessly with the lienholders, such as medical providers, who had claims against their clients’ recoveries.

But in 2022, as I reported at the time, Mighty made a major pivot to directly compete against those PI firms with a dual-entity business in which Mighty helped deliver clients to its own partner law firm, Mighty Law, and supported that law firm with technology and services.

That pivot was driven by the same frustration that is driving Schwadron to make this even-more radical pivot now, which is that even though technology has enabled PI firms to operate more efficiently, they do not pass on any of that savings to their clients. They still charge the same contingency fees and still pass on every possible cost.

So he has decided to put those technology tools directly in the hands of consumers, in the belief that it will enable them to get a fair settlement before having to give away a third of it to a lawyer.

“We’ve evolved from a service provider for law firms to a technology-enabled law firm to what we’re now building, which is going to be the first stop that all consumers after an accident should visit,” Schwadron told me in an interview.

“It allows them to value their own claim and get a fair settlement offer from the insurance company before they ever need to decide whether to hire a lawyer and pay a 33% fee.”

A Third Option for Victims

The platform creates what Schwadron characterizes as a critical “third option” for accident victims who have historically faced a binary choice: hire a PI attorney and immediately surrender 33-40% of their settlement, or negotiate directly with insurance companies as an unrepresented individual.

“The insurance company is licking their chops,” Schwadron said of unrepresented claimants. “They are professional defendants. They know how to lowball you. They know how to pay as little as possible, and that is what their billion-dollar machine is set up to do.”

Mighty’s approach leverages AI to level that playing field. The platform collects information about accidents, obtains or receives police reports and medical records, analyzes documents using AI, and submits comprehensive settlement packages to insurance companies.

The AI is trained to understand insurance company tactics and to know how to push back against lowball offers, Schwadron says.

The company focuses exclusively on the 90% of personal injury cases that settle pre-suit – cases that Schwadron describes as “usually administrative.” If Mighty’s AI identifies a case as too complex to settle pre-suit, it immediately flags it for escalation to an attorney.

How the Platform Works

Users begin by providing basic information about their accident to Mighty’s AI. The system can either accept uploaded police reports and medical records or retrieve them on behalf of the user.

The AI then analyzes these documents, summarizes the case details, and generates a “Live Estimate” of what the case is worth. This valuation of the claim is continuously updated and adjusted as new information becomes available.

This estimate draws on case-specific details, a rules engine created by personal injury experts, and leading large language models.

With the user’s permission, the AI then submits information to the insurance company and negotiates on the user’s behalf.

Notably, Mighty encourages users to obtain second opinions from attorneys even after receiving settlement offers – a recommendation the company shares with insurance companies to incentivize better initial offers.

“One of the things that we do is we actually refer people to a vetted network of lawyers who guarantee that they will not take a fee unless they actually improve on the offer that you got through Mighty,” Schwadron explained.

This creates a unique economic dynamic. Since attorneys typically charge 33% contingency fees, they must secure settlements at least 50% higher than Mighty’s AI-negotiated offers for clients to break even. Lawyers in Mighty’s network who accept these modified fee arrangements essentially guarantee they can add value – or they work for free.

Already Settling Claims

Mighty claims to have already settled multiple cases through the platform, with testimonials on its website showing settlements ranging from $5,500 to $8,500. Schwadron asserts these represent the first personal injury settlements “completely handled by AI.”

The company describes the AI as available 24/7 to answer questions about cases, the insurance process, treatment decisions, and even mental and physical health challenges following accidents. The system provides real-time updates whenever case circumstances change, from updated police reports to new settlement offers.

Mighty’s service is entirely free for consumers who use the AI to value their claims or negotiate directly with insurance companies. The company generates revenue only when users decide to hire attorneys from Mighty’s network, in which case the attorney pays Mighty a lead-generation fee.

A Critique of Legal Tech’s Impact

Underlying Mighty’s pivot is what Schwadron characterizes as a decade-long frustration with the economics of how legal technology has impacted personal injury practice.

The problem, Schwadron argues, is that AI and automation in personal injury law have enriched firms without benefiting consumers.

“Every legal technology company building for personal injury law firms simply is just making law firms richer,” Schwadron said. “There is not one instance in all of personal injury that I am aware of a personal injury law firm taking the exponential gains they’ve gotten from technology and, more recently, AI, and passing any of that savings on as an economic benefit to the consumer.”

Law firms are “exponentially more efficient” and can take on two to three times as many cases, yet consumers pay the same contingency fees.

“It’s not only bad for the consumers who are in accidents, who are amongst the most vulnerable of us, but it’s actually bad for society because the torts are growing as a larger percentage of GDP,” Schwadron contends.

The UPL Question

The platform’s direct-to-consumer approach is likely to raise questions for some about whether it is engaged in the unauthorized practice of law.

But Schwadron says the platform cannot be considered to be engaged in UPL because it uses only software, no humans, to negotiate settlements.

“Our software does not exercise legal judgment reserved for licensed attorneys,” Mighty’s website says. “It facilitates the pro se (self-represented) process by providing public information and document preparation tools leveraging the power of LLMs.”

In addition, the site says, Mighty makes it easy for users to “escalate” their case to lawyer by facilitating introductions to qualified lawyers in all 50 states.

It is starting out by focusing on motor vehicle accidents because those cases tend to be simpler, the site says. And even for those cases, the system is designed to be conservative.

“Based on our data, our AI currently flags a much larger proportion of cases for Attorney Escalation than we expect to in the future. If a case is complex, we don’t just ‘let the AI handle it’ – we provide a one-click path to an attorney in our network.”

Not Making Friends

Even as AI proliferates across legal practice areas, including PI, most products focus on augmenting attorney productivity rather than replacing attorney involvement entirely.

Mighty’s direct-to-consumer approach represents a more disruptive model – one that could face significant resistance from the PI bar. Yet Schwadron seems undeterred by the prospect of antagonizing potential critics.

“We’re not going to create a lot of friends in the personal injury space,” he acknowledged. “But it’s just been too much to now watch AI exponentially change these law firms and consumers getting no economic benefit whatsoever.”

For consumers, Mighty’s value proposition is straightforward: free AI-powered case valuation and settlement negotiation, with the option to escalate to an attorney if needed, and only on terms that incentivize the lawyer to improve the outcome.

For insurance companies, the incentive is avoiding the 50% premium they typically must pay when cases go to attorneys, making fair settlements economically rational.

Whether this model proves sustainable – and whether it can navigate the regulatory and competitive challenges that may lie ahead – remains to be seen.

But it clearly represents an ambitious attempt to use AI not merely to assist legal services delivery, but to fundamentally restructure how legal services are accessed and priced in a major practice area.

Robert Ambrogi Blog

Robert Ambrogi Blog