Zebraworks today announced the launch of DataQ AI, an artificial intelligence-powered analytics platform designed to help law firms identify and address revenue cycle issues before they impact cash flow.

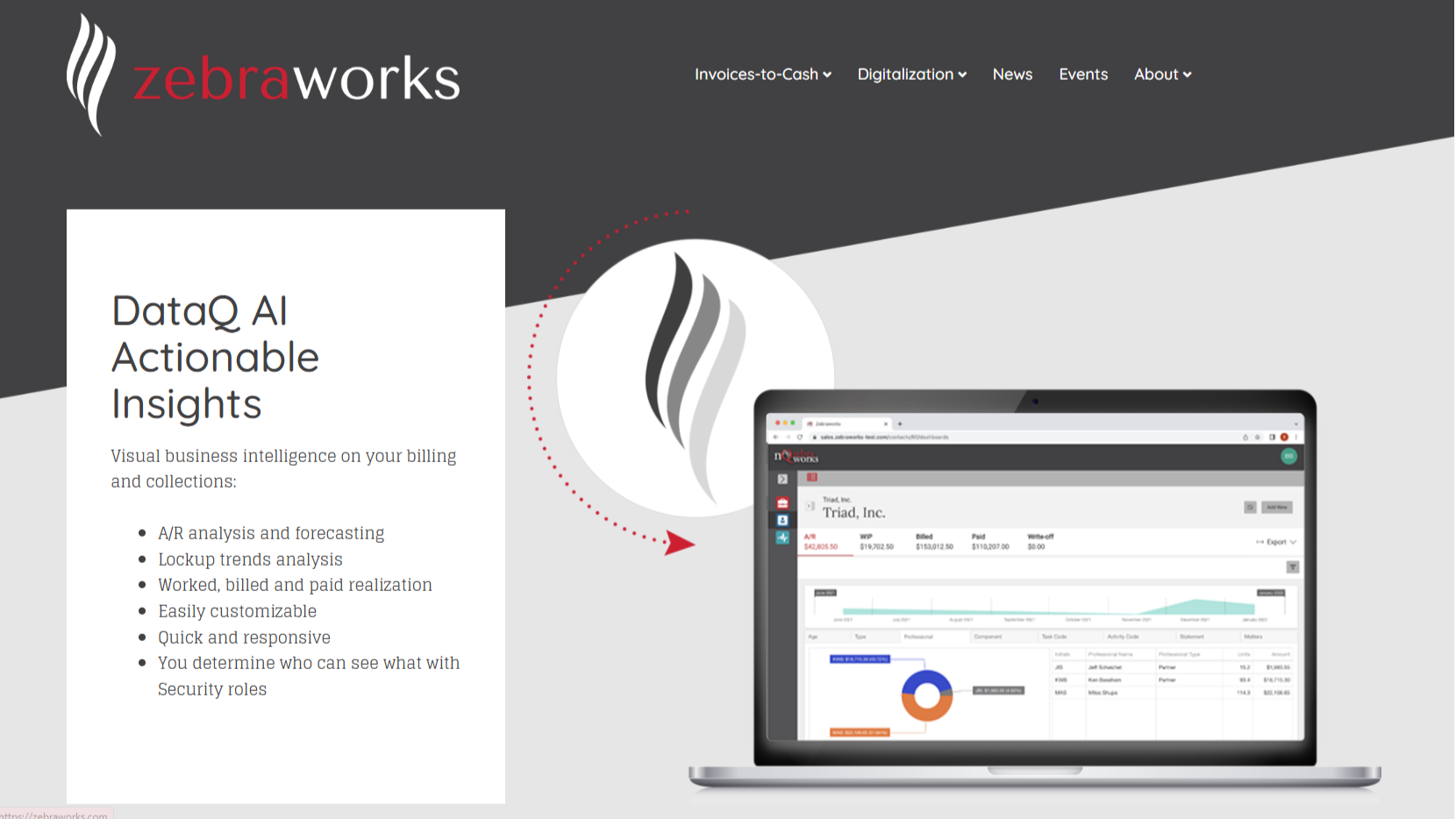

The new product, part of the company’s Invoices-to-Cash suite, analyzes billing and collections activity, accounts receivable, trust and retainer balances, and client payment patterns to surface actionable insights that can improve collected realization, shorten lockup periods, and enable more proactive revenue management.

According to CEO Bill Bice, the platform addresses a common challenge in law firm finance: not a lack of data, but the difficulty of knowing which signals require immediate attention.

“DataQ AI helps firms focus on what actually moves cash,” Bice said in announcing the product. “It gives teams clarity on where to act—before revenue slows down.”

From Business Intelligence to Predictive Action

The launch represents an evolution of Zebraworks’ existing DataQ business intelligence tool, which the company introduced in 2022 as part of its move into practice management technology. While the original DataQ provided visual dashboards and reporting capabilities atop a data warehouse, DataQ AI adds artificial intelligence to identify strategic exceptions and prioritize intervention opportunities.

The platform monitors for patterns such as clients paying outside their normal cycles, skipped or partial payments, shifts in creditworthiness, and situations where work-in-progress or receivables exist despite available trust or retainer funds. When these signals are detected, DataQ AI routes them to the appropriate firm roles for early intervention.

For billing and collections teams, this means less time spent on aging reports and more focus on matters that most significantly impact cash flow. For finance leaders and firm management, the platform promises clearer visibility into revenue risk and opportunity.

Building on Momentum

The DataQ AI launch comes as Zebraworks says it has been experiencing significant growth and expansion.

In December 2024, the company closed a $4.5 million funding round led by parent company Reckon Limited, bringing total investment to $13.5 million.

More recently, the company hired veteran legal technology executive Jake Laliberte to lead UK and EMEA expansion of its Invoices-to-Cash offerings, and appointed Kristi Pierson, formerly global client director at Elite, as managing director for the Invoices-to-Cash suite.

The company was formed in 2020 through the merger of nQueue, which specialized in printing, scanning and cost recovery solutions, and Zebraworks, a cloud integration platform founded by Bice, who was formerly CEO of ProLaw. It serves 40% of the Am Law 200, 12 of the top 20 law firms globally, and hundreds of mid-sized firms across 52 countries.

The Invoices-to-Cash suite includes BillQ, which automates billing workflows and integrates with existing financial management systems; PayQ, a next-generation merchant account for accepting online payments; and now DataQ AI for intelligent analytics. These solutions complement Zebraworks’ document workflow products, which include scanning, print management, and cost recovery tools.

While many legal tech companies have added AI features to existing products over the past year, Zebraworks is positioning DataQ AI as purpose-built for the specific challenge of revenue cycle management—an area where timing and prioritization can significantly impact a firm’s financial performance.

Robert Ambrogi Blog

Robert Ambrogi Blog