Remember Pan Am? It was the world’s largest international airline for much of the 20th century and an innovative pioneer in the modern airline industry. But when its management failed to appreciate the dramatic changes underway in the industry, it suffered a series of economic blows, and management’s last-ditch efforts to save it came too late.

The Thomson Reuters Institute, in its 2024 Report on the State of the US Legal Market, released today in partnership with the Center on Ethics and the Legal Profession at Georgetown Law (whose URL returns a page not found), uses Pan Am’s story to drive home a simple point for U.S. law firms: Innovate or die.

“Law firm leaders who fail to respond to [changes in the legal market] and pivot quickly enough to prepare for the future may see their firms destined for the same fate as Pan Am,” the report warns.

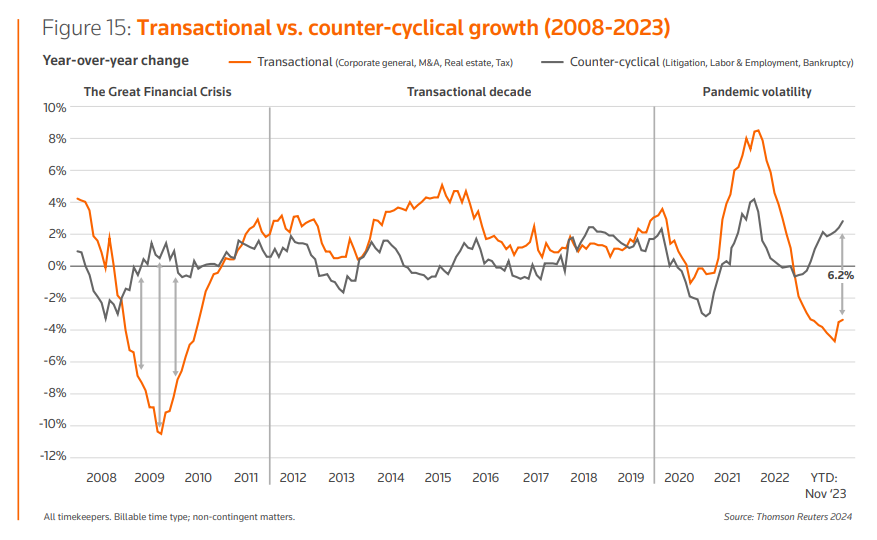

The legal market has shifted, the report says, from “the Transactional Decade” of the 2010s, “a period marked by easy-to-borrow money and strong performance for law firms’ transactional practices,” to the period we are currently in where most of the growth in demand for law firm services has been driven by practices that run counter to general economic conditions, such as litigation, bankruptcy, and labor and employment.

Accompanying that shift has been the rapid increase in the pace of law firm rate growth, the report says. Over the past year, it finds, “the rates clients agreed to pay law firms for new matters grew by more than 6%, with every segment of law firms seeing aggressive increases in

worked rates on par with the pace seen prior to the Great Financial Crisis of 2008-’11.”

But at the same time, many law firms have found it more difficult to collect on those increasing rates, and clients have become more likely to try to dole work out in tiers to lower-cost firms as a way to control their costs, the report says.

Further complicating the market now and into the future is the advent of generative artificial intelligence, Thomson Reuters says. “On the whole, law firm leaders appear to be optimistic about the potential that Gen AI offers for the future of the practice of law, but some skepticism remains.”

Other key findings from the report:

- Different sizes and segments of law firms have taken significantly different approaches to staffing. While the largest firms are actively cutting back on associate headcount, midsized firms are aggressively growing their associate ranks.

- While law firm expenses have moderated somewhat compared to 2022, the overall picture for expenses remains unclear due to persistent high growth in overhead expenses and an apparent resurgence in direct expenses due to increases in salaries and associate hiring.

- The one-two punch of sagging productivity and declining realization rates have put a pinch on law firm profitability growth. This has happened to such an extent that even the high pace of rate growth has been largely unable to remedy the situation.

- In selecting outside counsel, “buyers of legal services seem to be reverting to prior preferences for specialist knowledge, responsiveness, and global coverage.”

Gen AI’s ‘Massive Impact’

On the topic of generative AI, the report says it is “likely to have a massive impact on many aspects of law firm business.” Having said that, it lays out three potential scenarios for what the impact of Gen AI on the legal industry might look like:

- The rising tide. In this scenario Gen AI significantly enhances both client value and law firm profits “Clients benefit from higher-quality advice, faster service, and more creative solutions, while firms see reduced operational costs and improved labor efficiency.” All of this results in major shifts in staffing, career paths, pricing and methods of internal education, and challenges to the ability of law firms to showcase their value to clients. “Those firms that can harness innovation to demonstrate that value will more easily be able to differentiate themselves in the crowded legal market going forward.”

- A lopsided landscape. In this scenario, clients leveraging Gen AI to assert further control over legal services, diminishing law firms’ traditional roles and enabling clients to claim the majority of the technology’s value at the expense of firms. That means clients handling more work inhouse, demanding more competitive and transparent pricing, and further diversifying their legal service providers. “For those firms that adopt new innovations but aren’t successful at articulating their benefits to clients, this scenario could be especially painful.”

- No big thing. In this scenario, “Gen AI simply does not have a significant strategic impact on law firms,” instead serving more utilitarian roles in areas such as knowledge management, operations, marketing, IT, and HR, all without notably changing client benefits or firm costs. While the report calls this scenario implausible, it says that some version of it is likely to crop up in isolated pockets. “Some firms, practice areas, and regions at one time or another may see little actual difference compared to a world in which the full impact of the latest technology never materialized. For firm leaders, that means they need to assess the potential impact of Gen AI on a case-by-case basis, identifying areas where it may be insignificant or where it could offer significant opportunities for growth.

Traits of Successful Firms

In the face of these challenges and changes, what is a law firm to do? The report offers suggestions based on the strategies of those law firms that appear to have been most successful in recent year. Looking at firms’ financial results over the past 10 years, it ranked those in the top quartile as “Dynamic Firms” and those in the bottom quartile as “Static Firms.”

(In this regard, the report is reminiscent of the Future Ready Lawyer Survey Report published annually by Wolters Kluwer, which ranks firms as Leading, Transitioning and Trailing).

Thomson Reuters found that Dynamic Firms share several key traits:

- An ability to read the market more astutely than their competitors. During the decade that transactional work prevailed, they shifted their practices in that direction more quickly than their competitors.

- An ability to balance demand growth and staffing projections better than other firms, experiencing only minimal productivity losses despite having stronger headcount growth.

- A willingness to expand roles for non-lawyer professionals and more robust investment in technology, marketing and business development, and high-level support staff, as well as smart investments in people, both for fee earners and support staff.

Thomson Reuters wraps up its report where it began — with a warning to law firm leaders: “Leaders can choose to ignore these changes but, like the leaders of Pan Am, they do so at their peril.”

“Leaders who can rise to this challenge will be able to lead their firms confidently into the future. Those who do not, will — like the leaders of Pan Am — leave their organizations ill-equipped and vulnerable to the vagaries of the marketplace, often offering the wrong services in the wrong ways and wondering why nothing they do is working like it used to.”

Robert Ambrogi Blog

Robert Ambrogi Blog