With AI-driven tools for founders, attorneys and investors, a company called Dori is today launching out of stealth, offering a generative AI platform for private market transactions.

The company is also announcing $2 million in seed funding, which it closed last year, with participation from Counterpart Ventures, Correlation Ventures, Service Provider Capital, and a number of what it describes as “prominent” corporate attorneys.

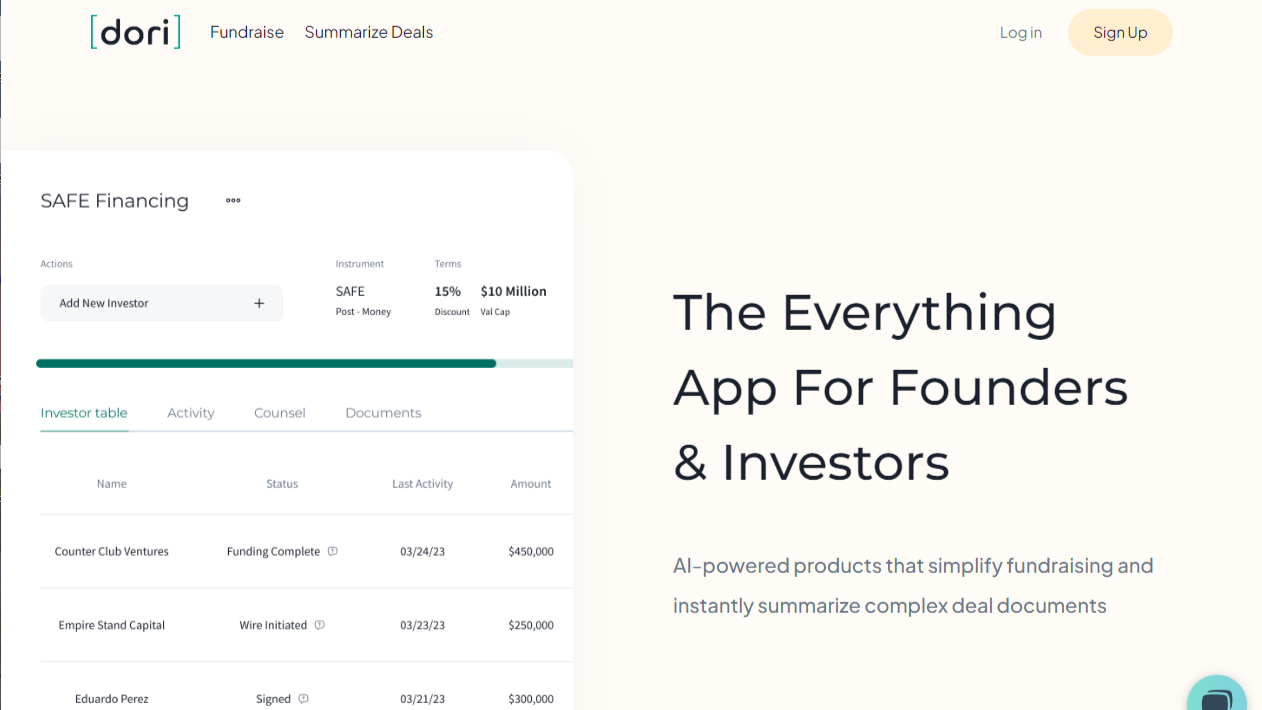

Describing itself as “the everything app for founders and investors,” Dori offers three products for venture capital transactions:

- Convertible instrument platform. This free tool is designed for startups, to help them confidently complete their fundraise by being guided through the board consent process, choosing a market standard document, selecting market standard economics and tracking signatures and wires.

- Preferred stock financing automation. Dori says that this tool, targeted at attorneys, uses custom large language models similar to OpenAI’s GPT-4 in order to automate the generation of venture equity financing deal documents in a matter of minutes. The platform allows attorneys to automatically generate the more than 200 pages of preferred stock financing agreements from a term sheet with a drag-and-drop interface.

- Investment summarization and insights. Using a mesh of proprietary machine learning models that work in tandem, this product can read, analyze and summarize legal and economic terms contained in preferred stock financing documents in a matter of seconds, Dori says. Investors can link their data rooms to Dori to analyze historical deal documents or upload deal documents on an active fundraise to identify key legal and financial terms before committing to an investment. This summarization platform is in closed beta and will be available on May 23, Dori says.

Atlanta-based Dori was founded by Sarosh Shahbuddin, who is its CEO, and Ivan Antolic-Soban, who is its CTO. Both previously worked for the voice biometrics company Pindrop, Shahbuddin as director of product and engineering and Antolic-Soban as a backend software engineer.

“We’ve trained our generative AI models on thousands of venture financing documents to provide high-quality, market standard documents in minutes,” Shahbuddin said in a statement put out by the company. “By having access to both historical trends as well as real-time deals, we can provide unique insights into market conditions so attorneys, founders and investors can make informed decisions and reduce the time it takes to analyze, draft and negotiate these transactions.”

The convertible instrument platform is available immediately. For the preferred stock financing automation tool, lawyers can join a waitlist here. For investment summarization, investors can join a waitlist here.

Robert Ambrogi Blog

Robert Ambrogi Blog