In the first of its promised expansions into other practice areas following its acquisition last November by LexisNexis, Lex Machina today announced its addition of securities law to its legal analytics platform.

Until today, Lex Machina had focused exclusively on intellectual property. But ever since its acquisition by LexisNexis, Lex Machina has planned to use LexisNexis’s extensive collection of federal and state docket data to expand into other practice areas, starting with federal practice areas.

“The whole theory of the acquisition was to enable us to get access to the LexisNexis documents,” Owen Byrd, Lex Machina’s chief evangelist and general counsel, told me last week. “Rolling out securities is our proof point that the acquisition made sense and that it can accelerate our vision of bringing analytics to all practice areas.”

Securities cases are available in Lex Machina starting today. The collection includes nearly 15,000 federal securities litigation cases and over 1 million securities-specific docket entries filed since 2009.

By mid-September, Lex Machina will add antitrust dockets, followed before the end of 2016 by products liability, employment, commercial law and commercial bankruptcy. Additional federal practice areas will come in 2017, after which Lex Machina will turn its attention to adding data from state dockets.

“This is the beginning of our sprint to deliver analytics for all of federal law,” Byrd said.

Analytics Specific to Securities Law

Lex Machina, which originated out of Stanford Law School, uses sophisticated analytics to mine court data to reveal insights about judges, lawyers, parties and matters.

To expand its analytics to securities, it had to first code the documents it received from LexisNexis with tags specific to the practice area. To develop those tags, Byrd told me, Lex Machina’s developers spoke to a number of leading securities litigators to find out what analytics they would want to know.

Among the analytics included in the new securities module are:

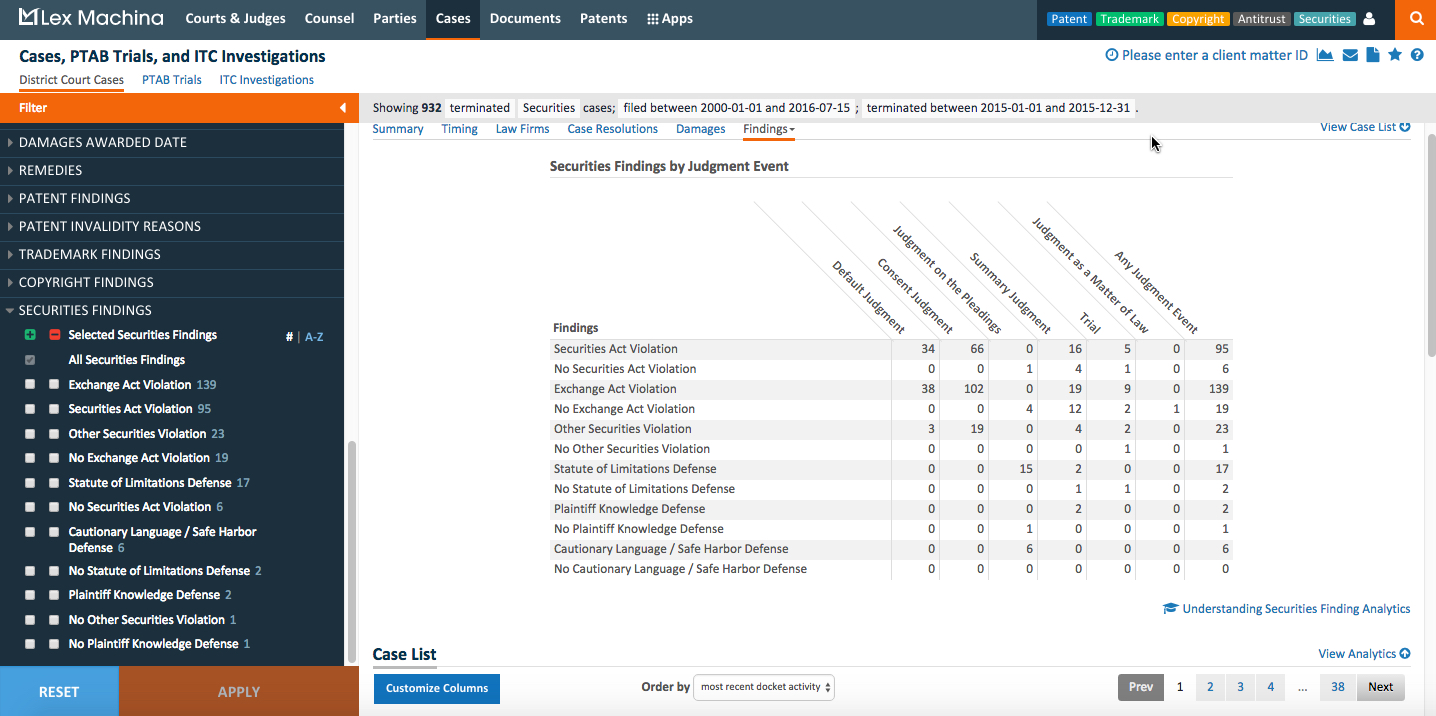

- Securities findings by judgment event. This shows findings — such as Securities Act violation, Exchange Act violation, statute of limitations defense, plaintiff knowledge defense, cautionary language/safe harbor defense — by judgment event — such as default judgment, consent judgment, summary judgment, etc.

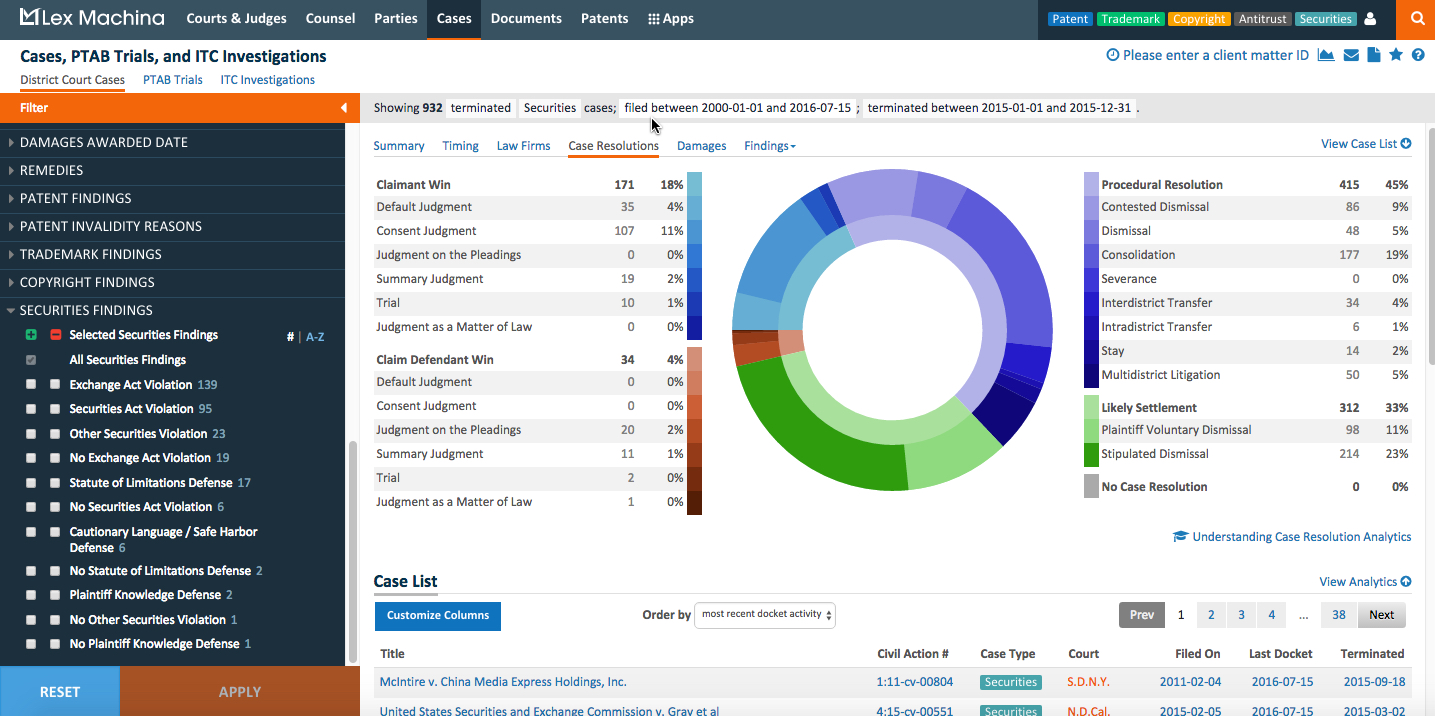

- Case resolutions. Specifically created for multi-district litigation, such as class-action lawsuits tried in district courts across multiple U.S. states.

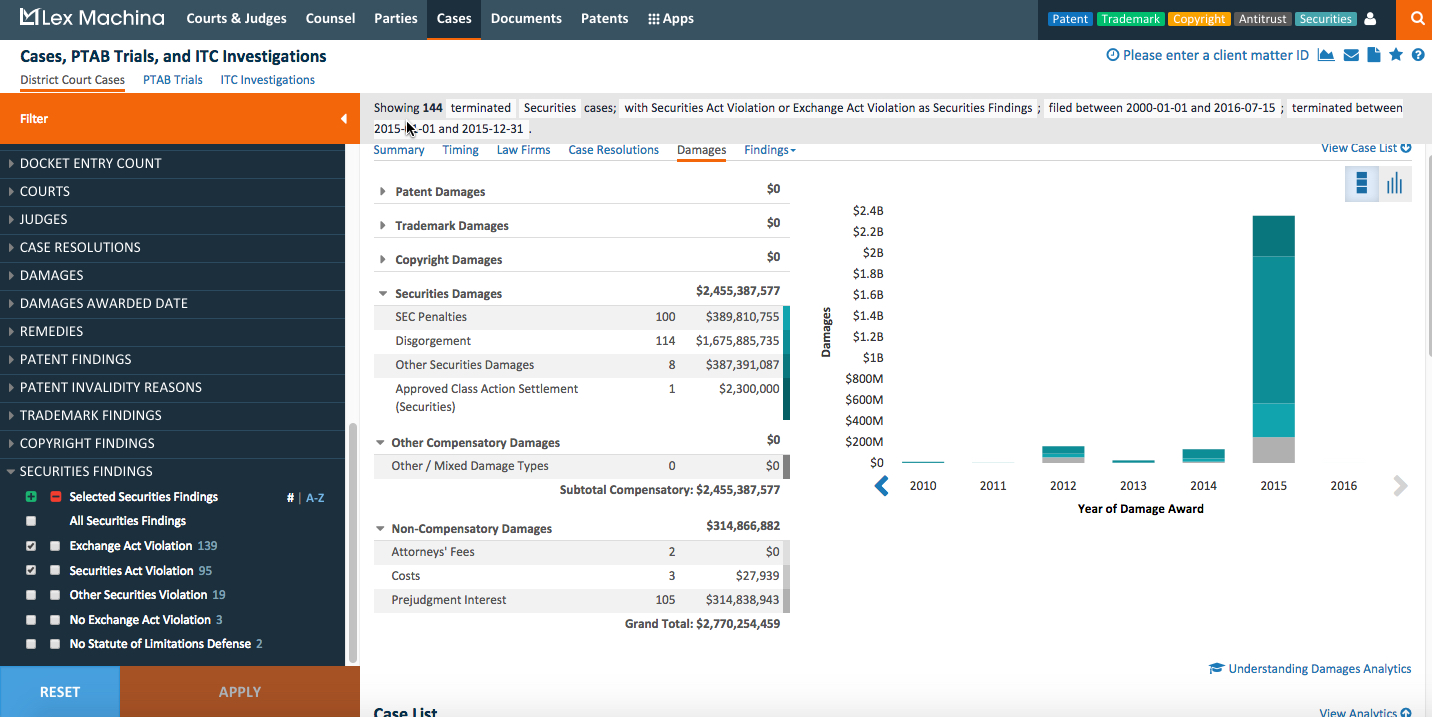

- Damages. Categorizes the amounts awarded for SEC penalties, disgorgement, approved class-action settlements and other securities damages.

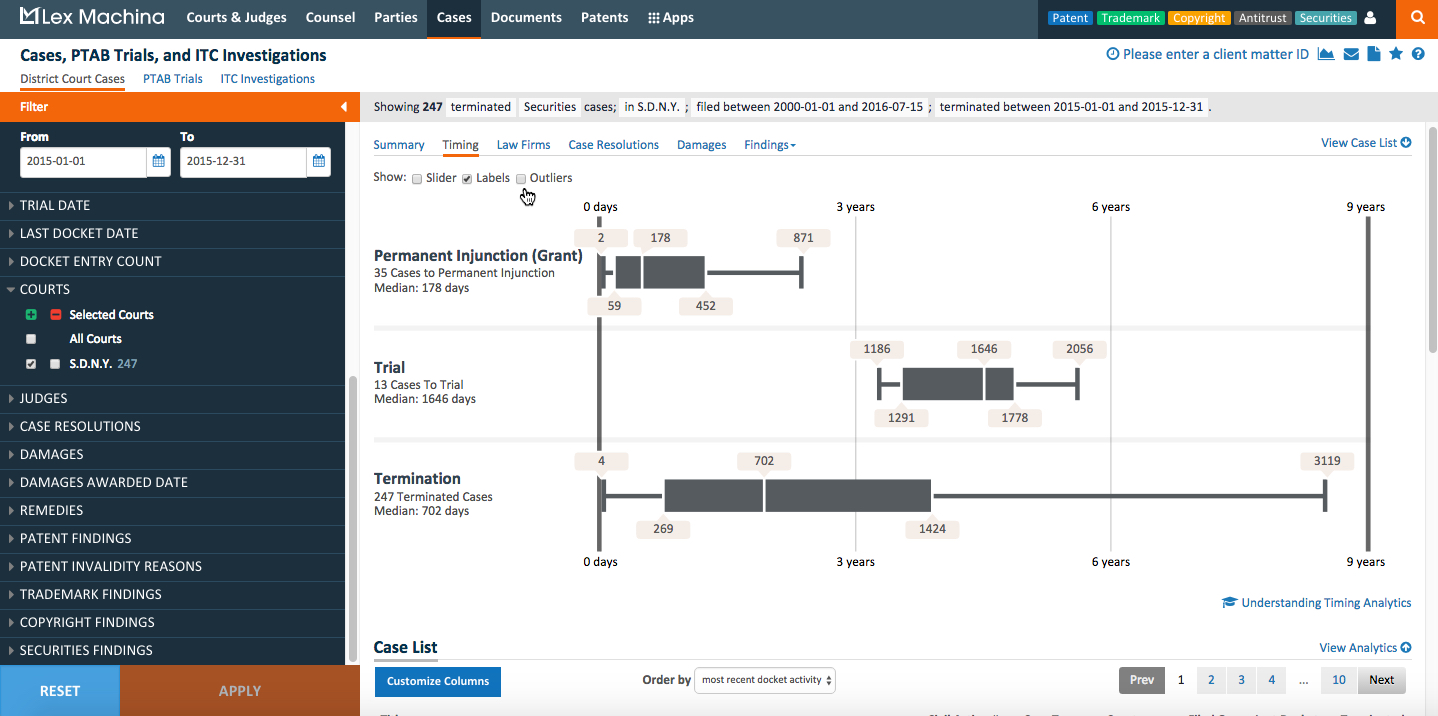

- Timing. Reveals average times for a case to reach class certification, summary judgment, dismissal and more.

2015 Case Statistics

With today’s roll-out of the securities module, Lex Machina also unveiled statistics on securities cases that terminated during 2015:

- Most frequent defendants in securities litigation were Citigroup Global Markets (43 cases), Goldman, Sachs & Co. (36 cases), and UBS Securities (35 cases).

- Law firms most frequently representing defendants were Latham & Watkins (48 cases), Simpson Thatcher & Bartlett (41 cases) and Dechert (39 cases).

- Law firms most frequently representing plaintiffs were Pomerantz (107 cases), Robbins Geller Rudman & Dowd (99 cases), Glancy Prongay & Murray (46 cases) and the Rosen Law firm (46 cases).

To read more about the company, see my posts tagged Lex Machina.

Robert Ambrogi Blog

Robert Ambrogi Blog