In what it is calling a new category of software for attorneys and CPAs involved in financial investigations, Valid8 Financial, a developer of forensic accounting software, today is introducing Verified Financial Intelligence (VFI), an automated solution for extracting and verifying financial evidence.

The software extracts transaction evidence from various sources, including client accounting systems, bank statements, brokerage statements, check images, wire details and transaction lists, and then applies algorithms to compare that evidence with accounting records and trace the flow of funds among accounts and entities.

The software, which could be considered an e-discovery point solution for financial evidence, has an array of applications for high-value financial investigations such as high net worth divorces, Chapter 11 bankruptcies, mergers and investigations, fraud investigations, and government investigations, the company says.

Chris McCall, co-founder and CEO of Valid8 Financial told me that the product was developed to address the lack of integration among different sources of financial data, which limits the data’s usefulness.

Although there has been an explosion of FinTech investment into products that simplify access to financial information such as bank statements, check images, broker statements, and financial statements, the process of integrating that data can be cumbersome and time consuming, eating up as much as 80-90% of a diligence engagement.

The VFI product collects financial data from multiple sources — including client accounting systems and independently sourced accounting evidence — and enriches and verifies it so that users can visualize the full cash flow, or “follow the money,” as McCall said.

“In the last 10 years, there’s been an explosion of fintech investment into new solutions that simplify access to accounting evidence and financial data, but they lack the integration between different sources, limiting their usefulness for CPAs and attorneys,” McCall said. “Our approach addresses this data gap, helping customers measure risk in financial statements, allowing them to narrow their focus to the most critical areas — drastically increasing the speed to opinion.”

The software could be used, for example, by a family lawyer to find undisclosed assets or analyze a spouse’s lifestyle. It could be used in an M&A transaction to verify revenue or to automate proof of cash.

Key Features

Key features of the VFI software platform, the company said, include:

- Client accounting system extraction that provides streamlined data extraction from more than 30 types of systems. Matching algorithms compare banking activity to accounting entries to achieve full population verification; compress time to execute proof of cash, subsequent AR, and revenue verification; and eliminate sample risk.

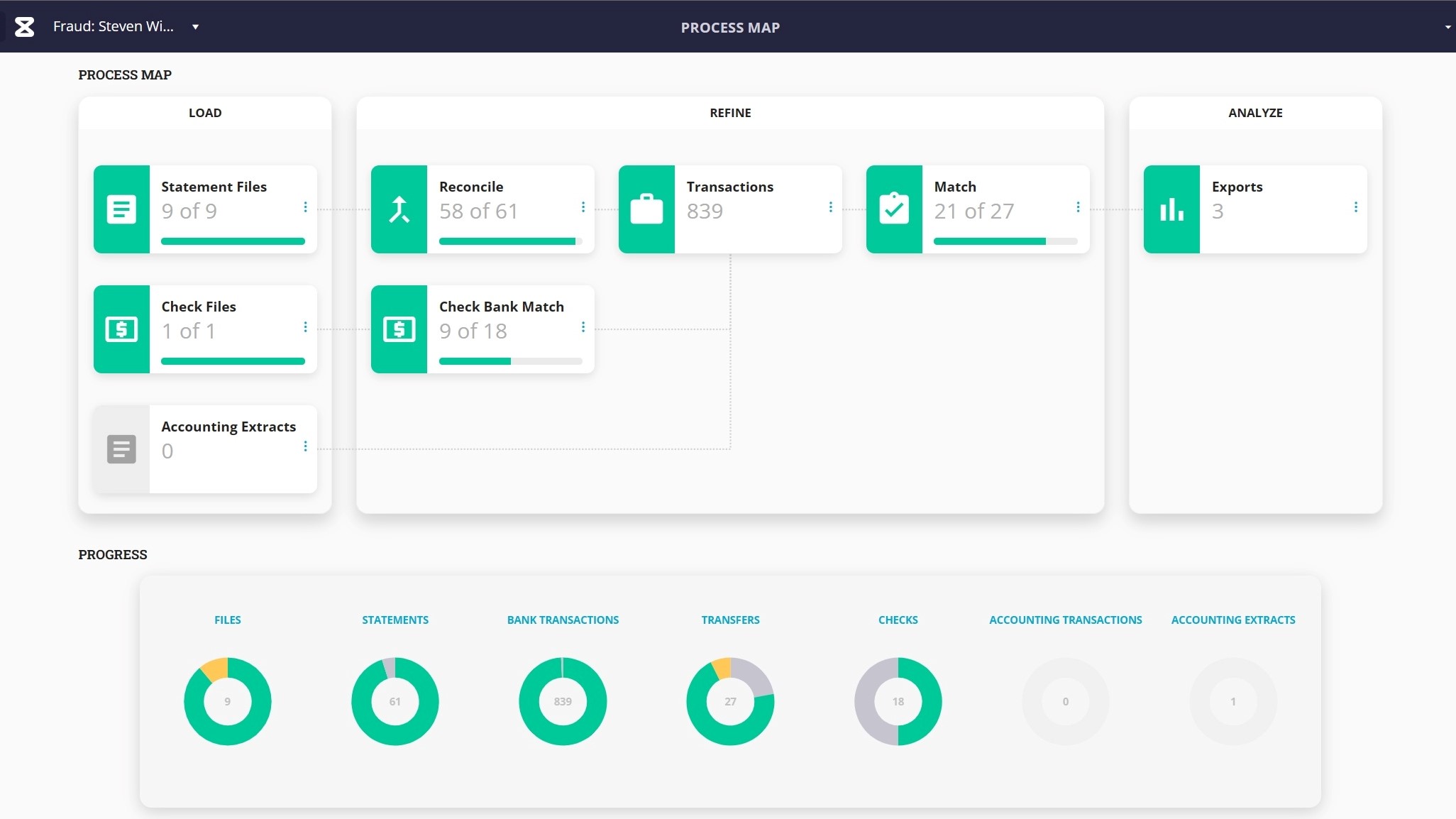

- A process-driven user experience that displays a self-guiding process map (pictured above), live progress bars for each step and one-click navigation to any view or task. A firm can leverage a single evidence-collection process and user experience, eliminate manual data work, accelerate data preparation, reduce training time and standardize procedures across the firm.

- Improved cash flow visualization that includes Sankey diagrams showing the flow of funds between accounts, legal entities and financial statement accounts. It allows users to quickly understand and explain complex data sets with left-to-right storytelling. All nodes and flows have relative size accuracy, are fully interactive and provide one-click export of transactions. These data visualizations simplify the exploration of large data sets.

McCall describes the product as drawing on two types of data. One is the accounting evidence that includes items such as bank statements, brokerage statements, loan statements, check images, deposit slip images, wire details, transaction lists, and the like. The other is the accounting data — sourced from QuickBooks, Sage and other accounting systems — that puts the evidence into context.

All of that comes into the VFI platform, where it is enriched, enhanced and verified, and then transformed into process maps and Sankey diagrams for showing the flow of funds between accounts, legal entities, and financial statement accounts.

McCall said there is no other product on the market like this with the ability to associate financial data horizontally across transactions and systems, rather than vertically by silos of transactions. “The only way you can do that is by doing what’s called tracing the accounting cycle.”

Until now, that has been a completely manual procedure, by which you are trying to understand a network of associated transactions, so you can see that money flow across financial statement accounts over time and eventually hit the bank account.

“The only way you can do that is to understand the data associations,” McCall said. “So you need to understand the transactions in your cash journal, in your accounting system, and how they relate to the bank account activity. Then you need to understand how your cash journal interacts with payments. And then you need to understand invoices and payments. And then you need to understand how invoices are related to revenue.

“That’s what our patent is. It’s creating all of these associations and stitching all of this information together so that we can give you that horizontal view of what happened over time.”

Robert Ambrogi Blog

Robert Ambrogi Blog